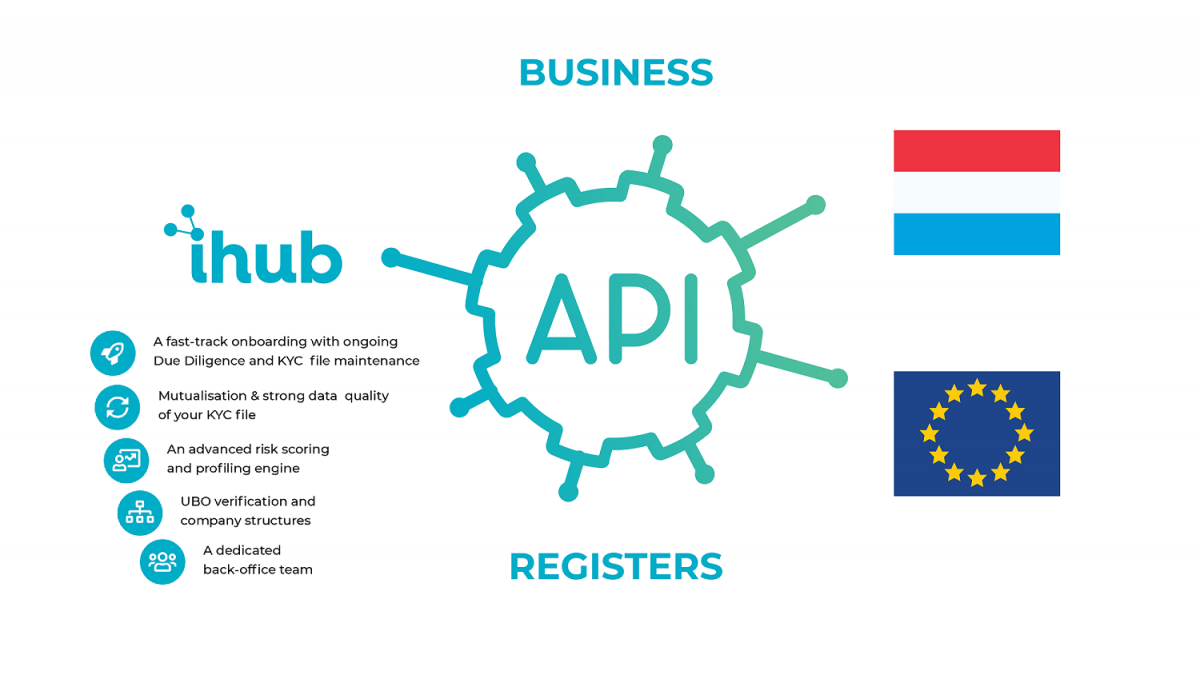

Since this summer, i-Hub has been using the new LBR APIs to speed up the review of its clients’ KYC files. Indeed, i-Hub has developed a system that manages automated connections to 10 European business registers, allowing it to collect the latest information on legal entities in a matter of minutes in order to enable its teams to finalise the periodic review or onboarding exercises.

Access to European and global business registers is uneven, as they all have different degrees of maturity and openness. For example, some have been offering APIs (software interfaces that allow software to be connected to a service in order to exchange structured data) for several years and others still do not. The advantage of APIs is the possibility of interconnecting information systems in order to obtain data that can be directly integrated and used without human intervention before verification.

Thus, by making its new APIs available to professionals, LBR facilitates the consultation of the Trade and Companies Register (RCS) and the purchase of company profiles, making the processing of KYC files faster and more qualitative.

After being one of the first test users of the new LBR APIs, i-Hub integrated them into its processes for updating information on Luxembourg legal entities this summer by modifying its search engine for European registers.

Pascal Morosini, CEO of i-Hub explains: “Our clients have customers all over the world but the particularity of the Luxembourg financial center and its numerous players means that legal entities incorporated in the Grand Duchy are numerous and varied. This is why the LBR remains by far the most important register for us and our clients, the automation of our verification processes thanks to the new APIs provides us with a higher level of integration, thus improving our quality and speed.

Yves Gonner, CEO of the LBR explains: “Luxembourg Business Registers (LBR) has the mission to manage the register of companies (RCS), the register of beneficial owners (RBE) and the electronic register of companies and associations (RESA). The dematerialised accessibility of legal and financial information on companies is a key priority for LBR.

LBR is committed to facilitating the accessibility of the information and documents it collects by offering its different types of clients technical means adapted to their needs. In this context, LBR offers a new platform specifically dedicated to the implementation of Application Programming Interfaces (APIs), providing automated access to professionals with significant information needs. The services currently offered will be further developed in the future by adding additional functionalities.

LBR wishes to continue its efforts and commitment to greater corporate transparency and the fight against fraud and money laundering.

Ananda Kautz, Head of Innovation, Payments & Digital – Member of the Executive Board of the ABBL explains: “In recent years, against the background of the increasing burden of compliance (in particular AML/KYC), increased competition and the pandemic, Luxembourg financial institutions have accelerated their digital transformation projects aimed at reducing costs and increasing efficiency in the medium and long term.

Such digitisation initiatives by financial institutions often require direct and indirect interactions with various databases such as those managed by Luxembourg Business Registers (LBR). The ABBL welcomes and supports the recent introduction of an API for the private sector by LBR encompassing the electronic services of the Register of Commerce and Companies (RCS), and we hope that this access will be further extended to the Register of Beneficial Owners.

Overall, we at the ABBL are seeing an increasing number of API-based solutions in Luxembourg and we expect this trend to accelerate to the benefit of the domestic financial services sector. We are also pleased to see mutualisation initiatives developing in Luxembourg, as Luxembourg financial institutions have everything to gain from the size of the market and the opportunities offered by mutualised solutions.